Governor Sununu Vetoes Net Metering Bill in New Hampshire

Earlier this week, Governor Chris Sununu vetoed two energy bills, one of which would have expanded electric net metering practices in New Hampshire. Renewable energy advocates hope legislators will override his veto and push the bill into law. S.B. 446 would increase limits on net metering by towns and businesses, allowing bigger solar, wind, hydro and biomass projects to receive larger subsidies for the energy they generate. In a letter released Tuesday, Governor Sununu detailed his concerns, principally the massive economic costs the increased net metering caps would have on ratepayers across the state.

“These bills send our state in the exactly wrong direction. We need to be taking steps to lower electric rates, not passing legislation that would cause massive increases,” Governor Sununu stated in his missive following the vote. The Governor went on to point out that S.B. 446 would cost ratepayers at between $5 to 10 million annually and was a ultimately a handout to large solar energy developers.

Net metering is a bad deal for small businesses across New Hampshire. If signed into law, S.B. 446 would have quadrupled the state’s net metering caps, allowing residents who use solar panels to sell more of the excess energy they produce back to the power companies at inflated prices. This practice shifts the cost of grid upkeep back to non-solar users. Many small businesses who fit into this category ultimately pay higher rates and see no tangible benefit. Family Businesses for Affordable Energy believes that energy incentive projects should be able to compete on their own merits, and not place additional financial burdens on businesses and working families. Family Businesses for Affordable Energy applauds Governor Sununu on his decision and encourages leaders in other states to follow his example.

Tax Reform Continues to Lower Energy Bills for Small Businesses

In April, Family Businesses for Affordable Energy highlighted a long and growing list of utility companies that are passing the savings from tax reform on to their customers in the form of lower electricity rates. The Tax Cuts and Jobs Act slashed the corporate rate from 35% to 21%, and those reductions have provided tangible benefits for electricity users in the private and commercial sectors. Cost-conscious family businesses across the country continue to benefit from the renewed, enterprise-friendly tax and energy policies that Congress and the administration have enacted over the past year and a half. Since April, the list of utilities cutting rates on energy consumers has grown exponentially, reaching 101 as of June 6. One such example is Otter Tail Power Company. This investor-owned electric utility provides electricity for residential, commercial, and industrial sectors, serving 132,200 customers in 422 communities across Minnesota, North Dakota, and South Dakota. The company is headquartered in Fergus Falls, Minnesota, and has been in operation since 1909.

“Otter Tail sought to reduce its interim electric rate increase from 10.4 percent to 6.8 percent. Typical residential customers would see a reduction of about $3.10 a month, a company spokeswoman said, and business customers would see an $18.25 drop.”

The list is replete with similar examples of cost savings for small, family owned and operated businesses. These savings ensure that business owners can invest in new equipment, employ more people, and offer higher wages. The revised list of utility companies sharing the benefits of tax reform is below:

- Alabama Power

- Alaska Electric Light and Power

- Alliant Energy, Wisconsin

- Alpena Power Co.

- Ameren Illinois

- Appalachian Power Co.

- Arizona Public Service

- Atlanta Gas Light Co.

- AVANGRID

- Avista Corporation

- Baltimore Gas & Electric

- Black Hills Energy

- California Water Service

- Citizens’ Electric Company of Lewisburg

- Cleco Corporation.

- College Utilities

- Commonwealth Edison

- Consumers Energy

- Delmarva Power

- Dominion Energy, Utah

- DTE Energy

- Duke Energy Carolinas and Duke Energy Progress

- Duke Energy Florida

- Duke Energy Kentucky, Inc.

- Duke Energy Ohio, Inc.

- El Paso Electric Company

- Enstar Natural Gas Company

- Entergy Arkansas

- Entergy Louisiana

- Entergy Mississippi

- Entergy New Orleans

- Entergy Texas

- Eversource Energy

- Georgia Power

- Golden Heart Utilities

- Green Mountain Power

- Gulf Power Company

- Hawaiian Electric, Maui Electric, Hawai’I Electric Light

- Idaho Power

- Illinois American Water

- Indiana-Michigan Power

- Iowa American Water Co.

- ITC Holdings Corporation

- Kansas City Power and Light

- Kentucky Utilities

- Louisville Gas and Electric Company

- Madison Gas & Electric

- Metropolitan Edison Company

- Michigan Gas Utilities Corp.

- MidAmerican Energy Company

- Missouri American Water

- Montana-Dakota Utilities Co.

- National Fuel Gas Distribution Corporation

- National Grid

- National Grid Rhode Island

- Nevada Energy

- New Jersey American Water

- New Jersey Natural Gas

- Nicor Gas

- Northern Indiana Public Service Company

- Northern States Power

- NorthWestern Energy

- Oklahoma Gas and Electric Company

- Oncor Electric Delivery

- One Gas Inc.

- Otter Tail Power Co.

- Pacific Power

- PacifiCorp

- PECO Energy Company

- Pennsylvania Electric Company

- Pennsylvania Power Company

- Pennsylvania-American Water Company

- Pennsylvania-American Water Company-Wastewater

- Peoples Gas Company LLC

- Peoples Natural Gas Company LLC-Equitable Division

- Pepco

- Pike County Light & Power Company

- PPL Electric Utilities Corporation

- Public Service Company of New Mexico

- Public Service Enterprise Group

- Puget Sound Energy Inc.

- Quadvest

- Rocky Mountain Power

- SEMCO Energy Gas Co.

- Southwest Gas

- Spire Inc.

- Superior Water, Light & Power

- Tampa Electric

- The United Illuminating Company

- Tucson Electric Power Company

- UGI Central Penn Gas Inc.

- UGI Penn Natural Gas Inc.

- UGI Utilities Inc.

- Upper Michigan Energy Resources Corp. (UMERC)

- Upper Peninsula Power Company

- Vermont Gas Systems, Inc.

- We Energies

- Wellsboro Electric Company

- West Penn Power Company

- WeStar Energy

- Xcel Energy

View full list of companies giving benefits here: https://www.atr.org/list

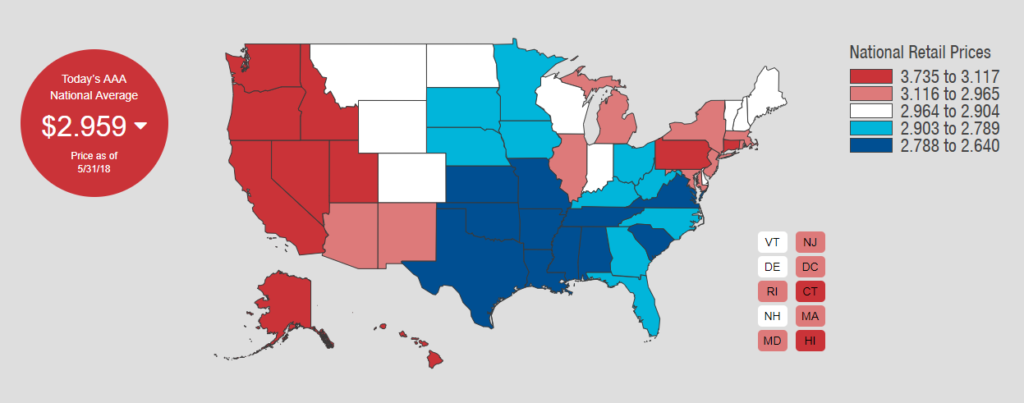

Summer Heat Brings Higher Fuel Costs

For most American’s summer means high heat and higher gas prices, and 2018 will likely be no exception. According to AAA, motorists across the country are on the brink of $3 per gallon for regular gasoline, with diesel fuel running $3.20. While these prices are a far cry from the $4-plus prices of 2008, the price increases for fuel are a real concern for small businesses across the country. The common reaction to gas price increases is to point to Congress and the administration for the added pain at the pump, however, the answer is a bit more complex than one would expect. As Nicolas Loris at the Heritage Foundation pointed out, “Because oil is a globally traded commodity, different factors around the world affect the supply of and demand for oil, which in turn affects the price Americans pay at the pump.”

In some ways, increased demand is a “good problem” to have. Fuel price increases can indicate that demand is high, businesses need fuel to function, and the market is reflecting the demand for more. However, that’s not the end of the equation. On the supply side, OPEC nations have been gradually reducing output, with 21 countries reducing production by a total of nearly 1.8 million barrels per day. This decrease in supply and increase in demand is driving up fuel prices. The increase in fuel prices has practical ramifications for small businesses. Tight margins and limited resources can cause small business owners to sweat, particularly when they can’t predict the future costs of fuel.

While increased domestic production alone may not solve the expense in the near term, it can help insulate the United States from price volatility in the future. The U.S. is poised to overtake Saudi Arabia and Russia as the world’s largest oil producers. The latest projection from the EIA estimates that U.S. production could reach nearly 12 million barrels per day in 2019. America’s energy revolution is a remarkable story that demonstrates the benefits of human ingenuity and entrepreneurial passion. FBAE continues to support policies that make it easier for the US to produce more fuel domestically because it will help keep fuel prices low into the future.

Connecticut Dismantles Net Metering

Both the Connecticut House and Senate have voted to pass S.B. 9, a bill that would roll back the state’s net energy metering program, much to the relief of ratepayers across the state who have been saddled with increasing energy costs to support Connecticut’s government-favored solar industry. While the legislation expanded the state’s Renewable Portfolio Standard to a 40 percent mandate by 2030, it also included provisions that significantly reduced the negative impacts of net metering by eliminating the system and supplanting it with what is known as a “buy-all-sell-all” incentive that would require a solar owner to sell his or her power to the grid at a new rate to be determined by the Public Utilities Regulatory Authority for a 20-year period. The user would have to buy back all the power they use at a retail rate. The buy-all-sell-all design separates consumption from production, which helps address the cost shift associated with net metering.

As FBAE has argued before, net metering unfairly shifts the costs of maintaining the grid and transmitting electricity onto non-solar customers, many of whom are family businesses. As solar panels proliferate, the fixed costs of the power grid must be shared over a smaller number of users. Utilities are now paying premium retail rates for the ever-expanding net-metered solar being generated in Connecticut, and they are not seeing the reduction in capacity, transmission and regional grid costs. As a result, non-solar ratepayers have been feeling upward rate pressure. Last year, Connecticut’s standard generation service rates increased twelve percent. Eversource and UI’s generation rate for residential customers increased by nearly twenty percent. These increases translate to sizable added monthly costs for businesses across the state. Net metering aggravates the problem by saddling ratepayers with ever-increasing prices. For small businesses with tight margins, every dollar counts. Rate increases exacerbated by cost-shifting add another obstacle for “mom and pop” family businesses trying to survive in the state that the Tax Foundation ranks 44th in the country for their business tax climate. FBAE applauds the Connecticut House and Senate for working to make the user/producer system more fair and friendly to family businesses across the Constitution State.

New Hampshire shouldn’t expand renewable subsidies on the backs of ratepayers

Family Businesses for Affordable Energy believes that New Hampshire ratepayers should not subsidize unsustainable and inefficient energy producers of any type and encourage the New Hampshire Senate to reject SB 446 in its current form. SB 446 would significantly expand the state’s net metering program by increasing amount of excess power solar producers can sell back to the utility company from 1 megawatt to 5 megawatts. In addition to exponentially expanding the net metering subsidy, the bill also propped up New Hampshire’s six remaining biomass plants with ratepayer money. SB 446 was on the brink of passage before legislators raised concerns regarding the tax consequences of the legislation. The subsidies for biomass were defended on the basis that those facilities are unable to compete against plants that run on natural gas and other lower-cost fuels. Ratepayers across the state would see a yearly increase of $20 million a year to prop up the plants. The House Science, Technology, and Energy Committee unanimously agreed to an amendment that eliminated biomass generators from the bill with the promise of subsidizing them via two other energy bills being considered. Representative Michael Harrington sponsored an amendment to reduce the rate for projects over 1 megawatt, which ultimately failed. The amended bill will now be sent back to the Senate. FBC opposes this bill because it perpetuates government support of favored electricity producers, forcing the rest of the market to subsidize expensive and inefficient technologies.

Tax reform is lowering energy bills across the nation

Tax reform has had transformative effect on businesses across the country. Regardless of size or structure, the reduced tax rates, added simplicity, and increased flexibility has had a net benefit for Main Street job creators. Skeptics need look no further than the ever-growing list of companies that reinvesting and offering bonuses to employees to see that the Republican tax plan is achieving the desired effect. Listed amongst the businesses that are giving back on the heels of tax reform are electrical utilities. At present, electrical utilities in 41 states, and more than 82.3 million customers nationwide have reduced rates on electricity. Consumers across the country are reaping the energy savings benefits of tax reform. The billions in tax savings to utility customers is providing significant infusions into the economy. More importantly, the tax cuts have had a cascading effect, empowering utility companies to track their tax savings and investigate ways to pass those on to customers. This week, state regulators in Ohio and Minnesota are petitioning utilities in their states to find savings, and in early March, Georgia Power and New Jersey Natural Gas announced rate reductions and refunds that counted in the billions of dollars in savings for ratepayers. “Reduced tax costs create an opportunity for BGE customers to benefit from further decreases in their total energy bills,” said Calvin G. Butler Jr, chief executive officer of BGE in a January 2018 Baltimore Gas & Electric press release. For family businesses, lower electricity rates are great news, particularly for the inventory-rich, cash-poor enterprises that operate on slim margins. For these businesses, every dollar counts, and high, or volatile energy costs can be detrimental to prosperity. Conversely, lower, predictable energy costs result in savings that can be reinvested in the business. This means that business owners can hire more employees, invest in new equipment, and offer staff higher wages. A partial list of companies reducing energy prices is below:

- Alaska Electric Light and Power (Juneau, Alaska)

- Ameren Illinois (Chicago, Illinois)

- Arizona Public Service (Phoenix, Arizona)

- AVANGRID (Orange, Connecticut)

- Avista Corporation (Spokane, Washington)

- Baltimore Gas & Electric (Baltimore, Maryland)

- Black Hills Energy (Rapid City, South Dakota)

- Cleco Corporation. (Pineville, Louisiana)

- Consumers Energy (Jackson, Michigan)

- Dominion Energy (Utah)

- DTE Energy (Detroit, Michigan)

- Duke Energy Florida (St. Petersburg, Florida)

- El Paso Electric Company (El Paso, Texas)

- Enstar Natural Gas Company (Anchorage, Alaska)

- Entergy Arkansas (Little Rock, Arkansas)

- Entergy Louisiana, LLC (New Orleans, Louisiana)

- Entergy Mississippi (Jackson, Mississippi)

- Eversource Energy (Boston, Massachusetts)

- Georgia Power (Atlanta, Georgia)

- Green Mountain Power (Colchester, Vermont)

- Gulf Power Company (Pensacola, Florida)

- Hawaiian Electric, Maui Electric, Hawai’I Electric Light (Honolulu, Hawaii)

- ITC Holdings Corporation (Novi, Michigan)

- Kansas City Power and Light (Kansas City, Missouri)

- Louisville Gas and Electric Company and Kentucky Utilities Company (Louisville, Kentucky)

- National Grid (Waltham, Massachusetts)

- National Grid Rhode Island (Providence, Rhode Island)

- New Jersey Natural Gas (Wall, New Jersey)

- Northern Indiana Public Service Company (Merrillville, Indiana)

- NorthWestern Energy (Butte, Montana)

- Oklahoma Gas and Electric Company (Oklahoma City, Oklahoma)

- Oklahoma Gas and Electric Company (Oklahoma City, Oklahoma)

- Oncor Electric Delivery (Dallas, Texas)

- Pacific Power (Portland, Oregon)

- Pepco (Washington, DC)

- Public Service Company of New Mexico (Albuquerque, New Mexico)

- Rocky Mountain Power (Portland, Oregon)

- Spire Inc. (St. Louis, Missouri)

- The United Illuminating Company (New Haven, Connecticut)

- Tucson Electric Power Company (Tucson, Arizona)

- Upper Peninsula Power Company (Marquette, Michigan)

- Utility Services of Alaska (Fairbanks, Alaska)

- Vermont Gas Systems, Inc. (South Burlington, Vermont)

- WeStar Energy (Topeka, Kansas)

View full list of companies giving benefits here: https://www.atr.org/list

Offshore Energy Exploration Could Be The Next Bakken Oil Boom

Despite the United States being mired in a national recession, the state of North Dakota enjoyed the nation’s lowest unemployment rate and a billion-dollar budget surplus in 2012. North Dakota’s prosperity was achieved because the state was allowed to utilize new energy extraction technology to recover readily available deposits of oil and natural gas. In 2018, America may be on the cusp of the next energy boom, and this one has the potential to benefit business owners and individuals nationwide. On January 4th, the Trump administration announced a draft proposal to offer large swaths of offshore terrain comprising nearly 90% of the United States’ outer continental shelf to commercial oil and gas drillers. The move will be a reversal of President Obama’s 2016 decision to indefinitely block oil and natural gas exploration from the unleased offshore locations surrounding the continental United States and Alaska. In what will potentially be the largest lease sale ever, Interior Secretary Ryan Zinke said the draft proposal would offer leases to nearly 1 billion acres to drilling companies between 2019 and 2024. Currently, the Bureau of Offshore Energy Management (BOEM) permits offshore drilling in federal waters off the coasts of Alabama, Mississippi, Louisiana, Texas and parts of Alaska and California. BOEM currently manages about 2,900 active OCS leases, covering almost 15.3 million acres – the vast majority in the Gulf of Mexico. Fully implemented, Trump’s offshore exploration proposal would give energy companies access to leases to more than a billion offshore acres.

While offshore drilling projects would generate billions of dollars in revenue for state and local governments, the economic benefits extend to far beyond enriching the federal government and drilling companies. Offshore exploration saves money for taxpayers, supports hundreds of thousands of jobs, reinforces our national security, and reduces the cost of energy for both individuals and businesses nationwide. Each year, small businesses collectively spend more than $60 billion on energy. Ten percent of small-business owners claim that energy is their single greatest cost – greater than wages, salaries, materials, and supplies. According to NFIB’s Energy Consumption poll, energy costs are one of the top three expenses for 35% of small businesses. Increased access to offshore leases will undoubtedly reduce energy costs by increasing supplies, driving down energy costs for America’s job creators. However, the economic benefits of offshore energy exploration extend beyond cost savings. According to the American Petroleum Institute, opening our coasts to offshore drilling would lead to over 450 billion in new private sector spending, creating over 840,000 new jobs across the country.

Offshore exploration is also good for the government, with projections generating more than $200 billion in cumulative revenue. It is projected that opening unleased waters to offshore drilling will contribute more than $70 billion per year to the U.S. economy. North Dakota’s fracking boom, offers a pertinent illustration of what happens to communities when energy companies can invest. Invariably, private investment flows into communities, and local economies begin to thrive. Skeptics need look no farther than the massive economic boom that came with Bakken energy exploration, which plummeted North Dakota to 2.4% unemployment. The state now ranks sixth in best states for infrastructure. Fracking investment has helped North Dakota’s small businesses by creating opportunities across the state. Furthermore, fracking has made energy bills in North Dakota some of the lowest in the nation. Gas bills plummeted $13 billion per year from 2007 to 2013 because of increased fracking, which adds up to $200 per year for gas-consuming households. Moreover, all types of energy consumers, including commercial, industrial, and electric power consumers, saw economic gains totaling $74 billion per year from increased fracking.

Similarly, expanding drilling to America’s costs will bolster our economic and national security and provide states vital revenue and jobs that are needed to meet the increasing costs of state budgets. Many states, particularly those on the Atlantic Coast, lack dedicated infrastructure to support drilling operations, which provides an opportunity for businesses across the country to deliver the human and material substructure needed to support exploration efforts. FBAE believes that energy production is not only critical to our economic and national security but also keeps the lights on and energy costs low for main street job creators. It’s time for a pragmatic approach to our energy policy, and opening America’s offshore regions to energy exploration would be a bold step towards lasting economic prosperity for states governments, businesses, and consumers.

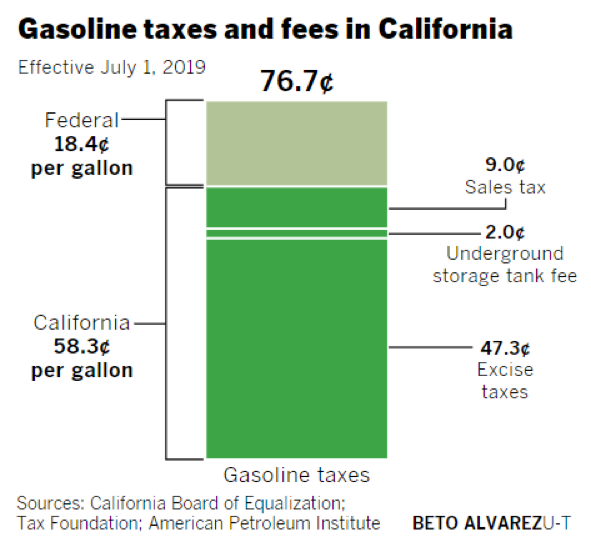

Jerry Brown – The Grinch That Wants to Steal Christmas

California Governor Jerry Brown is pushing California’s already high cost of gasoline to the highest in the continental United States, just in time for the holiday driving season. Five months after deriding President Trump for pulling the United States our of the Paris Climate Agreement, Governor Brown is waging a personal war on consumers with a gas tax increase. As of November 1st, Californians saw an increase of 12 cents per gallon on gasoline and 20 cents per gallon of diesel, making California the state with the second highest in fuel taxes behind Pennsylvania. The tax hike comes as the state transitions to “winter-blended” gasoline. Winter blends have a higher Reid Vapor Pressure or “RVP” – a measure of how quickly a fuel evaporates at a given temperature. The higher RVP of winter blended gasoline ensures that vehicles can start and run efficiently in colder weather. Generally, winter blended fuels are less expensive, averaging about twelve cents cheaper than summer blends. Governor Brown’s fuel tax hike eliminates the price disparity between winter blends and summer blends, effectively nullifying the price break consumers have enjoyed over the holiday season.

Gov. Brown’s gas tax hike is a big bah-humbug for small businesses in California. In addition to costing California taxpayers $5 billion per year, increased fuel costs put a pinch on job creators. This means business owners will hire fewer new employees, cut benefits, and reduce year end bonuses for workers. Consumers can expect to pay more for the goods and services they currently enjoy. As one southern California flower shop owner explained, “We do about 100 deliveries a week and we go all throughout L.A. County,” he said. “I’m going to have to reduce my delivery area and also let some of my employees go. This is absolutely unbelievable. I know we have more roads and cars on the streets, but all these years the money that was collected for gas taxes, car taxes and all of the other taxes has gone somewhere else.” The tax increase is designed to coincide with a $52 billion infrastructure plan signed into law earlier this year. Sadly, better roads and bridges are a Christmas present that Californians will probably never see. The state has a history of diverting funds earmarked for “infrastructure” into other projects that have little or no infrastructure relevance. In 2015, California politicians dipped into transportation funds to pay debt service on general obligation bonds, and in 2006, California Democrats diverted $20 billion in transportation bonds into the general fund to free up revenue for other projects.

Fortunately, some policymakers in the state are fighting back. State Assemblyman Travis Allen is leading an initiative to repeal this latest gas tax hike which requires 365,880 signatures to be gathered from registered voters. In an attempt to mislead voters, Governor Brown and Attorney General Xavier Becerra amended the summary ballot language in a misleading way in an attempt to confuse voters about the intent of the initiative. In response, Assemblyman Allen filed a lawsuit to correct the description. Sacramento Superior Court Judge Timothy M. Frawley tentatively ruled that the state-written title and summary of an initiative to repeal the recent gas-tax increases were misleading and should be rewritten. Currently, Allen’s initiative has garnered less than 25 percent of the necessary signatures while another repeal proposal from Republican attorney Thomas Hiltachk met that threshold Dec. 13, according to the Secretary of State’s office.

Family Businesses for Affordable Energy supports Assemblyman Allen’s efforts and acknowledges that an increase to fuel costs will disproportionately harm small, family owned and operated businesses across the state. Sacramento has come to be known as a black hole for taxpayer dollars, and history will repeat itself with another tax increase. Repealing this the gas tax will be a welcomed Christmas gift in December of 2018.

Blog: Pennsylvania Marcellus Shale Tax

Last month, the Pennsylvania state Senate voted in favor of a massive tax increase as part of a plan to close the state’s $2 billion budget gap. The 26-24 vote will result in a tax hike of 571.5 million across the state, affecting over half of households in the form of increased heating bills. While the tax hike will be a great revenue raiser for the government, small businesses will face an uphill battle in the form of fewer jobs, and the suppression of the state’s newest and most vibrant revenue stream. The vast majority of the tax hike is targeted at the state’s booming natural gas industry. The nation’s largest natural gas field, the Marcellus Shale, is located in Pennsylvania. The new severance tax will raise an estimated $100 million each year with an effective tax rate for 2017-18 of 2 cents per thousand cubic feet of natural gas. The state’s natural gas industry has been a target of Pennsylvania Governor Tom Wolf throughout his tenure as Governor. In February, he proposed a 6.5 percent tax on the value of the production. In 2015, he had proposed a 5 percent production tax, plus 4.7 cents per thousand cubic feet. Despite the fact that Governor Wolf has been forced to settle for roughly half of his desired tax rate, there are still significant problems with targeting the natural gas industry. The severance tax is far from the steady revenue source needed to reduce the deficit. The natural gas industry is cyclical with periods of robust growth and decline. No one knows how long the state can depend on revenue from the Marcellus Shale developers. Supporters of the tax have pointed to the fact that Texas also levies a similar tariff on their natural gas. However, as Elizabeth Stelle from the Commonwealth Foundation points out,

“If Texas is really the model to follow, then any severance tax proposal should also include eliminating the corporate income tax, eliminating the personal income tax and streamlining Pennsylvania’s regulatory regime. Sadly, that’s not the type of severance tax the governor and lawmakers want. Their idea is to raise the special tax charged to drillers—now called an “impact fee”—when the industry is already struggling with year-long permit delays for permits that do not even exist across the border in Ohio, ongoing litigation to build critical infrastructure, and the highest effective corporate tax rate in America.”

With Pennsylvanians already paying increased taxes and regulatory costs, it’s unfair to levy an additional burden on energy producers. Onerous government-imposed tariffs exist outside the free market, and not only distort the cost of labor, but tangible goods as well. Instead of clobbering hard-working Pennsylvanians with yet another tax increase, we encourage Governor Wolf to leverage the Marcellus Shale for greater investment that will create jobs.

US set to reduce carbon output without need for government mandate

Recent news has highlighted the United States pulling out of the Paris Climate Agreement, however few articles have mentioned the US’s already impressive record of reducing carbon emissions without a government mandate. According to a new study by Morgan Stanley, the United States may meet the outlined minimums of the Paris Climate Agreement despite no longer being a party to the accord. In their recent analysis, the brokerage firm found that technology is steadily driving down the price of these energy sources to the point that market functions will eventually make renewable energy an equitable possibility for large-scale power.

“We project that by 2020, renewables will be the cheapest form of new-power generation across the globe,” Morgan Stanley analysts said in a report published last Thursday. According to the report, the US is to exceed the Paris commitment of a 26-28 percent reduction in its 2005-level carbon emissions in the next three years. The report points out that better understanding of wind conditions and redesigned wind-turbine blades have made wind power an increasingly viable power option.

Many in the environmentalist community will point to the cost reduction as an argument in favor of maintaining the United States position in the Paris Climate Agreement, and for continued subsidization of green projects. However, we believe that if true, these statistics render the continued government subsidization of green projects completely superfluous. The goal of green energy projects should be to achieve competitiveness based on the merits of the technology, not financial support as an “approved power source” from the government.

The United States’ exit from the climate treaty has been treated as an environmental calamity by supporters of renewable energy, pointing to German Chancellor Angela Merkel’s steadfast support for the treaty as a roadmap for the US to follow. Interestingly, the math doesn’t favor that argument. The U.S. actually reduced its overall greenhouse emissions at a faster rate than Germany over the last decade. American emissions fell by 9.9 percent between 2005 and 2015, as compared with Germany’s 8.8 percent, even though the U.S. was not a signatory to any carbon emissions treaty during that period.

FBAE believes that it is critical for the United States to be judicious in the extent to which it tethers itself to the climate goals of other nations. Climate treaties place an undue burden on the American economy, and in the case of reducing carbon emission is proving to be unnecessary.