FBAE supports Kentucky Net Metering legislation – House Bill 227

In January, Kentucky Energy and Natural Resources Committee Chairman Jim Gooch introduced a bill that would amend the compensation rate for solar users who sell the excess power they produce back to the utility companies. The 14-year-old system compensates solar users at the full retail price of the electricity, versus the wholesale price for these sales. This practice ultimately shifts costs to non-solar customers. While criticisms of net metering often center around the adverse effects on low-income individuals, evidence shows that the problem also extends to the majority of small businesses who don’t want or can’t afford solar. FBAE all business owners should fairly share in the fixed costs necessary to maintain the energy grid.

FBAE drafted a letter to the Kentucky Legislature, supporting Chairman Gooch’s legislation, H.B. 227. The bill will amend Kentucky’s net metering compensation system by paying producers at the wholesale rate instead of the full retail rate they currently enjoy. Additionally, the bill is not retroactive, and will not affect current users in the state.

Jerry Brown – The Grinch That Wants to Steal Christmas

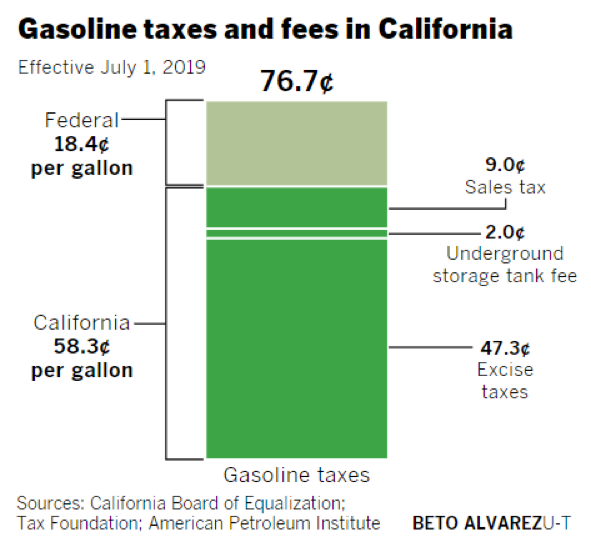

California Governor Jerry Brown is pushing California’s already high cost of gasoline to the highest in the continental United States, just in time for the holiday driving season. Five months after deriding President Trump for pulling the United States our of the Paris Climate Agreement, Governor Brown is waging a personal war on consumers with a gas tax increase. As of November 1st, Californians saw an increase of 12 cents per gallon on gasoline and 20 cents per gallon of diesel, making California the state with the second highest in fuel taxes behind Pennsylvania. The tax hike comes as the state transitions to “winter-blended” gasoline. Winter blends have a higher Reid Vapor Pressure or “RVP” – a measure of how quickly a fuel evaporates at a given temperature. The higher RVP of winter blended gasoline ensures that vehicles can start and run efficiently in colder weather. Generally, winter blended fuels are less expensive, averaging about twelve cents cheaper than summer blends. Governor Brown’s fuel tax hike eliminates the price disparity between winter blends and summer blends, effectively nullifying the price break consumers have enjoyed over the holiday season.

Gov. Brown’s gas tax hike is a big bah-humbug for small businesses in California. In addition to costing California taxpayers $5 billion per year, increased fuel costs put a pinch on job creators. This means business owners will hire fewer new employees, cut benefits, and reduce year end bonuses for workers. Consumers can expect to pay more for the goods and services they currently enjoy. As one southern California flower shop owner explained, “We do about 100 deliveries a week and we go all throughout L.A. County,” he said. “I’m going to have to reduce my delivery area and also let some of my employees go. This is absolutely unbelievable. I know we have more roads and cars on the streets, but all these years the money that was collected for gas taxes, car taxes and all of the other taxes has gone somewhere else.” The tax increase is designed to coincide with a $52 billion infrastructure plan signed into law earlier this year. Sadly, better roads and bridges are a Christmas present that Californians will probably never see. The state has a history of diverting funds earmarked for “infrastructure” into other projects that have little or no infrastructure relevance. In 2015, California politicians dipped into transportation funds to pay debt service on general obligation bonds, and in 2006, California Democrats diverted $20 billion in transportation bonds into the general fund to free up revenue for other projects.

Fortunately, some policymakers in the state are fighting back. State Assemblyman Travis Allen is leading an initiative to repeal this latest gas tax hike which requires 365,880 signatures to be gathered from registered voters. In an attempt to mislead voters, Governor Brown and Attorney General Xavier Becerra amended the summary ballot language in a misleading way in an attempt to confuse voters about the intent of the initiative. In response, Assemblyman Allen filed a lawsuit to correct the description. Sacramento Superior Court Judge Timothy M. Frawley tentatively ruled that the state-written title and summary of an initiative to repeal the recent gas-tax increases were misleading and should be rewritten. Currently, Allen’s initiative has garnered less than 25 percent of the necessary signatures while another repeal proposal from Republican attorney Thomas Hiltachk met that threshold Dec. 13, according to the Secretary of State’s office.

Family Businesses for Affordable Energy supports Assemblyman Allen’s efforts and acknowledges that an increase to fuel costs will disproportionately harm small, family owned and operated businesses across the state. Sacramento has come to be known as a black hole for taxpayer dollars, and history will repeat itself with another tax increase. Repealing this the gas tax will be a welcomed Christmas gift in December of 2018.

Poll Results Destin Residents Overwhelmingly Oppose Government Run Electricity 88% Oppose Municipalization of Electric Service 95% Want a Vote of the People

Huge majorities of Destin residents oppose the city creating a government run electric service, want the people to decide the issue if needed and want the Destin City Council to stop spending money on the municipalization process, according to a new poll conducted by Family Businesses for Affordable Energy (FBAE).

The Destin City Council has been considering creating a government run electric service by buying the assets of the local utility service. According to the city’s own feasibility service, the cost of such a purchase would be $71 million or more.

The FBAE poll is the first poll to ask the residents of Destin their views on the matter.

The poll found that 88 percent of Destin residents say they would vote ‘No’ on creating a government run electrical service. Another 84 percent of residents believe that their city government should not be in the business of providing electrical services.

“We protect family businesses all over the nation and these are some of the strongest poll results FBAE have ever seen on any issue,” said Alex Ayers, executive director of FBAE. “The people of Destin are angry, and they are adamant: they say NO to a government run electric service and believe Destin cannot afford such a thing.

“Destin voters are sending a loud and clear message to the Mayor and the City Council. They don’t want a government run electric service, and spending money on this folly needs to stop now,” Ayers said.

Other findings include:

- 95 percent say the people should decide this issue in a referendum, not by a vote of the Destin City Council. Only 12 respondents out of 300 polled trust the Council to decide this issue.

- 85 percent of Destin residents believe the city cannot afford $71 million or more to purchase an electrical system.

- 88 percent are satisfied with their current electrical service.

In fact, every argument made by Destin city officials in favor of municipalization – creating profits for city projects, burying power lines, improved service and storm response – were met by opposition of 73 percent or more across the board. Destin residents simply do not believe what the City Council has to say on this issue.

Large majorities of residents believe that if Destin did buy an electrical system, taxes and power bills would increase, service and storm response would suffer and the city would risk financial ruin.

“There is universal opposition to a government run electric service, and representatives of the people need to listen to the people,” Ayers said.

The survey was conducted by Tel Opinion Research for the FBAE. The survey was conducted on November 6 and 7 of this year. The sample consisted of 300 registered voters with a 6 percent margin of error at a 95 percent confidence level.

The complete poll is available here.

The FBAE also responded to a column published November 10 in the Destin Log by Gulf Power representative Bernard Johnson. In the column, Johnson asked the FBAE to stop interfering in the Destin municipalization issue.

“Family Businesses for Affordable Energy works on behalf of family businesses, we do not need Gulf Power or the City’s permission to work to protect the interests of family businesses and we plan to continue to fight for the people of Destin on this important issue,” Ayers said. “We fight for family businesses all over the nation and a government run electric service will severely damage Destin businesses and customers. The findings of our poll make it absolutely clear we are on the side of the people in this fight. And we will not stop until this issue is settled.”

ITC Shouldn’t Pick Winners & Losers in Solar Markets

Last month, the International Trade Commission ruled in a 4-0 decision that imported solar panels threatened the future of domestic manufacturing of solar components. The decision came after two solar manufacturers, Suniva and SolarWorld Americas petitioned the commission for tariffs. Suniva, which is 63-percent owned by a Chinese company, and SolarWorld Americas, whose parent company is a German firm, specifically requested a “40-cent-per-watt duty on imported cells and a 78-cent-per-watt floor price for imported modules. In lieu of the petition, the ITC has issued tariff recommendations that now await President Trump’s decision to implement within 60 days.

The commissioners offered three different recommendations, but it will be up to President Trump to decide on which recommendation to follow or to make completely new recommendations of his own.

- On the high end of the recommendations made by the ITC, the commission’s chairperson recommended a 35-percent tariff on all imported solar modules, as well as a four-year tariff of 30 percent on solar cell imports exceeding 0.5 gigawatts and a 10-percent tariff on cell imports under that limit. The tariffs would decline gradually.

- The intermediate recommendation suggested a 30-percent tariff on modules and a 30 percent tariff on imported solar cells more than 1GW. This tariff would also gradually decline.

- The third and most relaxed recommendation came from one commissioner who recommended a four-year import quota system that allowed 8.9GW of solar modules and cells to be imported in the first year.

Earlier this year, the solar advocacy group SEIA, which represents 1,000 solar industry companies worldwide, stated that Suniva’s requested tariffs could cause the industry to lose 88,000 jobs next year alone, more than one-third of the industry’s entire workforce. Many US-based solar companies would be negatively impacted by a tariff, specifically those that conduct R&D domestically, but manufacture abroad. A coalition of pro-free trade conservative groups joined SEIA in opposition to solar tariffs. Additionally, in April, a bipartisan group of 69 members of Congress Friday sent the ITC a letter urging the commission to reject the request from Suniva and SolarWorld.

While FBAE has stood as a staunch opponent of taxpayer giveaways to the solar industry, we also believe that the import cost of solar panels should be governed by the free market, not the ITC. This means allowing the market and the consumer to determine the success or failure of enterprise instead of using the government levy favorable tariffs at the behest of specific companies. Tariffs and import restrictions reduce employment and drive up prices for consumers. Furthermore, pro-tariff policies have a negative impact on blue-collar American workers in rural communities and increase the cost of electricity on businesses and families who utilize solar. For solar power to become a truly self-sufficient and economically viable energy source, the government should avoid picking winners and losers – penalizing some companies over others.

Destin Citizens Should Fight City’s Municipalization Effort

$71 Million Cost Just Too Risky for Business

The Family Businesses for Affordable Energy (FBAE) said today that area businesses should resist Destin, Florida’s, takeover of its electric service, warning business owners will face higher utility rates and higher taxes and fees, while seeing a reduction in service, reliability, and critical storm response.

The city of Destin, Florida, is looking at municipalizing the area’s electric service. In this case, Destin would buy and take control of the current electricity system now provided by Gulf Power, buying all the necessary assets to be the city’s power provider. Under the proposed scheme, Destin would operate its own government run electrical system.

“The results will be disastrous,” said Alex Ayers, Executive Director of the FBAE. “This has been tried recently around the country and business owners have been stuck with the bills.

“We are talking higher taxes and higher utility rates, while service and reliability drop significantly,” he said. “The bottom line is that Destin’s municipalization equals business owners paying a lot more and getting a lot less.”

Destin’s own municipalization study estimates the cost to Destin’s taxpayers will be at least $71 million, an amount of debt that is more than triple Destin’s $21 million annual city budget

It is even questionable if the $71 million initial cost estimate is accurate.

“These experts come into cities like Destin and low-ball the original costs estimates, leaving the city with sticker shock when the real price of municipalization comes in,” he said. “And business owners and taxpayers will get stuck with the bill.”

For example, Destin’s municipalization consultants, WHH, provided purchase cost estimates to the city of South Daytona of $9.5 million, then the price jump to $15.6 million. Fortunately, the voters of South Daytona rejected the city’s municipalization move by a vote of 62 percent.

Another city in Florida, Winter Park, was given a $15.8 million estimate by other consultants. The final price was $42 million to municipalize. In addition, the city of Winter Park lost $11 million in its first four years of government-run electric service.

And in Las Cruces, New Mexico, the city expected municipalization costs to be $30 million. When total costs soared to $110 million, Las Cruces abandoned its effort.

When cities face escalating and unexpected costs for municipalization, they turn to higher taxes, higher fees and higher rates. “The businesses of Destin can’t take this risk,” Ayers explained. “That kind of sticker shock will hurt business, kill jobs, and cause prices to rise for everyone.”

Government run electrical service can’t compete with investor owned utilities when it comes to service and reliability, especially when it comes to storm response, a critical need for locations like Destin. Municipalized cities like Tallahassee, Fort Pierce and Jacksonville have had highly publicized failures when responding to hurricanes and storms.

“Business just can’t afford the financial and safety risk of a city-run electric service,” Ayers said.

###

DOE grid study provides insight into grid reliability

Last April, Energy Secretary Rick Perry request a study of America’s electric grid to examine potential problems and solutions to maintain reliability. The study is of particular importance to family businesses who rely on affordable and reliable sources of electricity to run their businesses. Secretary Perry called for the study to not only examine the effects of renewable energy on the grid, but also develop policy prescriptions to help govern future energy production. Specifically, Secretary Perry sought to understand whether further increases in intermittent renewable energy sources would affect the reliability of the electrical grid and endanger base load power sources. Fears surrounding the study’s findings surfaced on both sides. Utility companies levied reasonable apprehensions about potential federal preemption of state energy policies on national security grounds. Exelon CEO Chris Crane made the case for a diverse energy portfolio and emphasized that nuclear energy’s contribution to baseload power generation was being “squeezed” and that the elasticity of nuclear energy made it an integral part of the power grid. Crane’s concerns are well founded. States like California have already begun to phase out nuclear energy production in the state.

Expectedly, in an attempt to head-off any criticisms of the reliability of renewable energy national green energy business associations like the Advanced Energy Economy, American Council on Renewable Energy, American Wind Energy Association, and Solar Energy Industries Association flooded the DOE with research arguing that the inclusion of more renewables in the power mix would have a measurable effect on system reliability. When the 154-page report was finally released late August, some environmentalist activists predictably belittled the study as a full-blown war on renewables and claimed that the study’s findings were a direct contradiction of what “other energy experts were saying” while others praised it as a fairly well-evidenced overview of the energy markets as they currently stand. Tom Kuhn, the President of Edison Electric Institute, which represents all U.S. investor-owned electric companies stated, “While we are still thoroughly reviewing the study, EEI has long advocated that our customers are best served by public policies that promote a balanced and diverse energy mix, which includes both traditional and renewable energy sources, and that also recognize the vital role 24/7 energy sources play in sustaining a secure, reliable, and resilient energy grid.” Kuhn went on to affirm the importance of energy production as an integral component of a robust infrastructure network that deserved investment, specifically pointing out the importance of defending energy infrastructure in the face of both man-made and natural disasters.

Ultimately the study details a few key findings. First, that market forces are driving baseload retirements, specifically the low price of natural gas as the largest contributor to maintaining older base load power plants. Nevertheless, the study indicated that coal, oil, and nuclear power generation still faces threats under the current market conditions, specifically with the difficulty in covering fixed costs in a market environment with cheap natural gas, subsidies for renewable energy sources, and government-mandated renewable energy goals. The report also pointed out the resiliency of coal-fired power plants and the stability associated with coal prices in comparison to the volatility of natural gas, as a positive for the continued use of coal power plants as part of base load production.

Our future energy grid must rely on sources capable of providing continuous output for base load power partnered with economically stable sources of electricity during peak load hours. States should examine their current goals, mandates, and subsidies for renewable energy production to ensure reliability and fair economic competition with base load production. We look forward to working with states to ensure family businesses are provided with affordable and reliable energy sources.

Keep political activism out of New Yorkers’ pensions

Activist investors have been on the rise in recent years, but their latest target on behalf of left wing environmentalists puts every day New Yorkers’ pensions in trouble.

New York state lawmakers are currently considering a proposal offered by state Sen. Liz Krueger that would mandate the state comptroller to begin divesting all state pension funds from energy companies producing coal, oil and natural gas by 2022. With New Yorkers already facing the highest state-imposed tax burden in the nation, and their state pension system confronting $250 billion in unfunded liabilities, it’s shocking that Albany would consider a measure as onerous to taxpayers as the New York State Fossil Fuel Divestment Act.

The state’s retirement fund is currently 92 percent funded, a shortfall of approximately $5,000 per private sector worker. If the divestment movement is successful, the loss from expected growth could reach the trillions in coming decades. New York Comptroller Thomas DiNapoli has come out against the bill. A Democrat and self-avowed environmentalist, DiNapoli is tasked with being the chief financial officer for the state, and now must weigh special interest activism against the creditworthiness of pensions for New York’s police, first responders, and other public employees.

If Krueger’s measure were to become law, the very people that the pension fund is designed to support would be most negatively affected. An arbitrary decision to divest from traditional energy companies will only increase unfunded liability gap, putting stress on the state’s ability to deliver on its promises to public employees.

A recent study conducted by University of Chicago Professor Daniel Fischel found that pension holders would see New York City’s funds shrink by over $100 million annually, and that divestment would have “minimal or no environmental impact.” New York City Employee Retirement System (NYCERS) alone would lose between $41 and $60 million annually; this adds up to nearly $700 billion over the next 50 years. Decreased returns on investment coupled with the ensuing wave of tax increases intended to offset the shortfall would undoubtedly land on the laps of many of the state’s workers. By rejecting this misguided legislation, New York lawmakers will be protecting public employees and workers statewide.

A burgeoning divestment movement is cropping up across the country, and New York is the latest example. Legislators across the country should follow the lead of Comptroller DiNapoli and keep political activism out of the pension system, focusing instead on driving returns that will ensure promises made to state retirees are promises kept.

Read at: http://www.stargazette.com/story/opinion/2017/08/20/yo-political-activism-ny-pensions/104723192/

Blog: US House of Representatives voting on bills to improve cross border energy infrastructure

On Wednesday, the House will take up two energy bills that aim to modernize the Untied States’ energy infrastructure. Back in June, Energy and Commerce’s Subcommittee on Energy and Power began considering these bills. Named the “Promoting Cross-Border Energy Infrastructure Act,” and the “Promoting Interagency Coordination for Review of Natural Gas Pipelines Act,” both bills focus on international cross-border pipelines which key players in the oil and natural gas industry are watching closely.

Earlier this year, the Senate drafted a letter requesting that any revisions of NAFTA consider the international movement oil and natural gas between the US, Canada, and Mexico. Born from that letter, the Promoting Cross-Border Energy Infrastructure Act is designed to expedite the process of obtaining permission from the federal government to construct structures that traverse American jurisdictions. One major complaint of American or oil and natural gas producers has been the lengthy and tedious permitting process that they must endure to obtain permission to build across the border. Republican lawmakers believe that the arduous permitting process encumbers companies and the legislation would “establish a predictable and transparent process to construct of cross-border pipelines and electric facilities”.

The Promoting Interagency Coordination for Review of Natural Gas Pipelines Act similarly addresses FERC’s role in the permitting process. In addition to requiring that siting processes be publicly disclosed, the bill encourages coordination between FERC and other participating agencies in order to expedite environmental impact reviews on for natural gas pipeline construction. Rep. Bill Flores, the author of the legislation commented, “America is one of the world’s top oil and gas producers thanks to the shale revolution,” Flores said. “Our energy infrastructure and permitting process must be updated to reflect America’s abundance of domestic energy resources. Modernizing the permitting process for the nation’s pipeline infrastructure allows us to efficiently and safely bring those resources to our downstream assets, ultimately to consumers, to power our economy, and to give opportunities to our hard-working American families.”

Chairman Walden of the House Energy and Commerce Committee praised both bills as prudent steps to putting consumer interests over those of bureaucrats and activists. With energy increasingly becoming a major cost to family owned and operated businesses, Family Businesses For Affordable Energy is encouraged by the steps Congress is taking to eliminate the red tape that hinders America’s economic growth.

US set to reduce carbon output without need for government mandate

Recent news has highlighted the United States pulling out of the Paris Climate Agreement, however few articles have mentioned the US’s already impressive record of reducing carbon emissions without a government mandate. According to a new study by Morgan Stanley, the United States may meet the outlined minimums of the Paris Climate Agreement despite no longer being a party to the accord. In their recent analysis, the brokerage firm found that technology is steadily driving down the price of these energy sources to the point that market functions will eventually make renewable energy an equitable possibility for large-scale power.

“We project that by 2020, renewables will be the cheapest form of new-power generation across the globe,” Morgan Stanley analysts said in a report published last Thursday. According to the report, the US is to exceed the Paris commitment of a 26-28 percent reduction in its 2005-level carbon emissions in the next three years. The report points out that better understanding of wind conditions and redesigned wind-turbine blades have made wind power an increasingly viable power option.

Many in the environmentalist community will point to the cost reduction as an argument in favor of maintaining the United States position in the Paris Climate Agreement, and for continued subsidization of green projects. However, we believe that if true, these statistics render the continued government subsidization of green projects completely superfluous. The goal of green energy projects should be to achieve competitiveness based on the merits of the technology, not financial support as an “approved power source” from the government.

The United States’ exit from the climate treaty has been treated as an environmental calamity by supporters of renewable energy, pointing to German Chancellor Angela Merkel’s steadfast support for the treaty as a roadmap for the US to follow. Interestingly, the math doesn’t favor that argument. The U.S. actually reduced its overall greenhouse emissions at a faster rate than Germany over the last decade. American emissions fell by 9.9 percent between 2005 and 2015, as compared with Germany’s 8.8 percent, even though the U.S. was not a signatory to any carbon emissions treaty during that period.

FBAE believes that it is critical for the United States to be judicious in the extent to which it tethers itself to the climate goals of other nations. Climate treaties place an undue burden on the American economy, and in the case of reducing carbon emission is proving to be unnecessary.

Blog: President Trump Kicks Off “Energy Week”

President Trump has designated the last week of June as “Energy Week”. Policy weeks have become a trademark of the Trump presidency, and for family businesses, the consequences of this Energy Week could be welcomed by many who are plagued with volatile energy costs. The common thread of Energy Week will be a renewed reliance on traditional energy sources, and dominance of U.S.-based fuels in the export market. The reversal of Obama-era energy policy was a key tenant of the President’s campaign, and based on his Energy Week schedule, Trump aims to make good on that promise. Now, Trump is looking forward, forging actionable plans to shape America’s energy future. In his first 150 days, the president has used his executive power to lift regulatory barriers to domestic energy production and has empowered the Interior Department to begin revisions of Obama-era fracking regulations.

The President has been outspoken on reducing regulations, providing greater access for energy extraction purposes, and encouraging energy production to help lower the cost of our energy production needs. While specifics on the President’s Energy Week plans are scarce, it is known that he will discuss oil and natural gas exports with Indian Prime Minister Narendra Modi when he hosts here today at the White House. On Tuesday, EPA Administrator Scott Pruitt will appear before a Senate Appropriations subcommittee where he will deliberate on the President’s spending blueprint. Energy Secretary Rick Perry will likely offer a preview of some of the President’s priorities when he speaks Tuesday with analysts and executives at the U.S. Energy Information Administration conference in Washington – agenda here. On Wednesday, President Trump will meet with Governors and Native American tribal leaders along with Energy Secretary Rick Perry. This meeting will precede a Thursday panel in the House Natural Resources Committee that will explore energy industry access to federal lands – link here. Finally, the President Trump will host and event at the Energy Department on Thursday where he will focus on how the sale of U.S. natural gas, oil, and coal helps strengthen America’s influence globally.

While President Trump is expected to place his policy focus on traditional energy sources, he is expected to describe openings for other energy exports, including U.S. technology that harnesses power from the wind and sun, and a new generation of advanced and modular nuclear reactors. Many in the industry have argued that the licensing rules for new reactors are cumbersome and convoluted, discouraging investment in an inexpensive and environmentally friendly energy source. There are hopes that President Trump will eliminate these hurdles.

In addition to making it easier to produce traditional forms of energy, the Bureau of Land Management is currently finalizing environmental reviews to allow leasing of federal land for the purpose of installing solar energy collectors in Nevada. The Dry Lake region on Nevada could be the first federal land installation of solar power generation in the country.

Streamlining the energy permitting process and reducing regulations will drive down costs, which is welcomed news for many family-owned and operated businesses with tight margins. FBAE is hopeful that the changes highlighted during Energy Week will lift the burden that stifles job creation and holds back our economic recovery.